Nse: Kprmill

Nse: Kprmill is the stock ticker symbol for KPR Mill Limited. An Indian textile company that produces yarn, fabric, and garments. The company stands firmly for quality and sustainability and has won numerous awards for its eco-friendly practices.

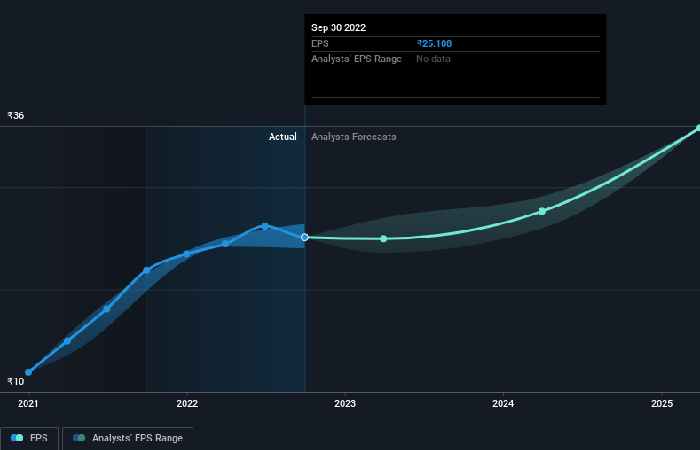

KPR Mill Limited has shown consistent growth over the years, with a net profit increase of 12.6% YoY. The company’s revenue has also increased by 5.5% YoY, a positive sign for investors.

However, it remains essential to note that the textile industry is highly competitive. And KPR Mill Limited faces stiff competition from other established companies. Additionally, the COVID-19 pandemic has significantly impacted the textile industry. And it remains to remain seen how KPR Mill Limited will navigate these challenging times.

Table of Contents

What Is Nse: Kprmill?

NSE stands for National Stock Exchange of India, a leading stock exchange in India. KPR Mill Limited is a publicly listed textile manufacturing company traded on the NSE. The company was incorporated in 1984 and had its headquarters in Coimbatore, Tamil Nadu, India.

KPR Mill Limited operates in various segments of the textile industry, including yarn, fabric, and garments. The company has a strong presence in domestic and international markets, exporting its products to over 90 countries worldwide. KPR Mill is known for producing high-quality products and for its sustainable and eco-friendly production practices.

As a publicly traded company on the NSE, KPR Mill is subject to various regulations and reporting requirements set by the exchange. It includes disclosing financial and operational information to shareholders and investors regularly. By being listed on the NSE, KPR Mill can access capital from a broad range of investors. And use the exchange to raise additional funds through equity or debt offerings.

About KPR Mill

KPR Mill Limited is one of India’s largest vertically integrated textile manufacturing companies, producing yarn, fabric, and garments. The company remainfounded in 1984 by Dr. K. V. Srinivasan and remained headquartered in Coimbatore, Tamil Nadu, India. KPR Mill has a strong presence in domestic and international markets, exporting its products to over 90 countries worldwide.

The company operates in various segments of the textile industry, including cotton, polyester, blended yarn, denim, and other fabrics. As well as men’s, women’s, and children’s apparel. KPR Mill is known for its innovative and sustainable production practices, and the company has received numerous awards for its commitment to environmental protection and social responsibility.

KPR Mill’s state-of-the-art manufacturing facilities are equipped with the latest technologies and machinery, enabling the company to produce high-quality products efficiently and cost-effectively. The company also has a strong distribution network, with over 2,200 retail outlets across India.

What is the Share Price of KPR Mill?

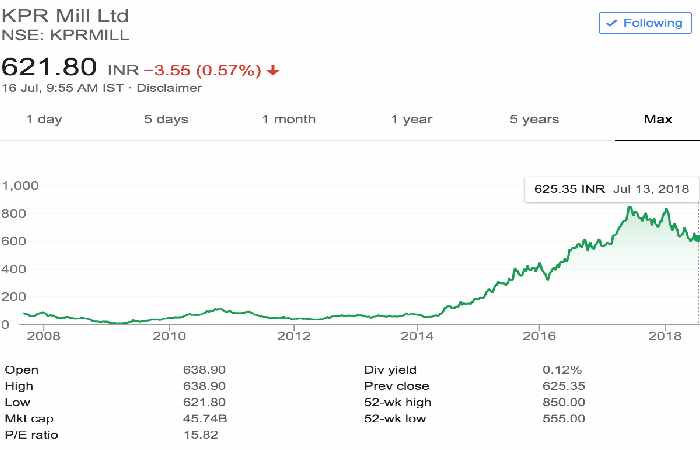

The share price of KPR Mill Limited on the National Stock Exchange (NSE) in India was around INR 1,400 per share. It was a significant increase from the previous year when the share price was trading at around INR 500 per share. The rise in the share price remained attributed to the company’s strong financial performance, innovative production practices, and commitment to sustainability.

KPR Mill Limited has remained listed on the NSE since 2007, and as a publicly traded company, its share price is subject to fluctuations in the stock market. Various factors influence the company’s share price, including market trends, economic conditions, and financial performance.

Investors can track the share price of KPR Mill Limited on various financial websites and through stock market trading platforms. It is essential to conduct thorough research and analysis before investing in any stock, as the stock market can be volatile and unpredictable. It remains recommended to consult a financial advisor before making any investment decisions.

Is KPR Mills a good buy?

I can tell you that KPR Mills Limited is a well-established company in the textile industry with a strong reputation for quality and sustainability. It has shown consistent growth over the years and has a good track record of financial performance.

However, conducting thorough research and analysis is essential before making investment decisions. The textile industry is highly competitive, and external factors such as the COVID-19 pandemic can significantly impact the company’s operations and financials. It is advisable to consult with a financial advisor or conduct your research to make an informed investment decision.

Who Owns K.P.R. Mill?

KPR Mill Limited remain a publicly traded company listed on India’s National Stock Exchange (NSE). The company had a market capitalization of around INR 9,500 crores, or approximately USD 1.3 billion. The company remains owned by diverse shareholders, including retail investors, institutional investors, and promoters.

The promoters of KPR Mill Limited are Dr. K.V. Srinivasan, Mrs. Malarvizhi Srinivasan, and their family members. Dr. Srinivasan is the company’s founder and Chairman, and he continues to play an active role in the company’s management and strategic direction.

Apart from the promoters, KPR Mill Limited has many institutional investors, including mutual funds, foreign institutional investors, and insurance companies. Some of the major institutional investors in the company include HDFC Mutual Fund, SBI Mutual Fund, ICICI Prudential Mutual Fund, and Franklin Templeton Mutual Fund.

How much did NSe: Kprmill Share Price Performed This Year?

The stock price of KPR Mill remain affected by various factors, including macroeconomic trends, company-specific news, and market sentiment. The performance of the company can remainevaluated by comparing its stock price movements over a specific period with the broader market or industry peers.

However, past performance is not necessarily an indicator of future returns. And various uncertainties can impact a company’s stock price performance.

It’s essential to conduct thorough research and analysis before making any investment decisions. This can involve studying financial reports, monitoring market trends, and consulting with financial experts to gain a better understanding of a company’s prospects and the broader market dynamics.

What is the Market Cap of KPR Mill?

As of April 20th, 2023, KPR Mill’s share price on the National Stock Exchange of India (NSE) is INR 935.85. According to the latest information available, KPR Mill has 93,279,630 outstanding shares.

Using these numbers, we can calculate KPR Mill’s market capitalization as follows:

Market Cap = Share Price x Outstanding Shares Market Cap = INR 935.85 x 93,279,630 Market Cap = INR 87,224,584,070

Therefore, as of April 20th, 2023, KPR Mill’s market capitalization is approximately INR 87,224,584,070 (or USD 1.2 billion).

It is important to note that market capitalization is a dynamic metric frequently changing as share prices fluctuate, new shares remain issued, or existing ones remain repurchased. Additionally, market capitalization alone may not provide a complete picture of a company’s financial health or performance. s it does not consider factors such as debt or cash reserves. Investors should consider multiple metrics and conduct thorough research before making investment decisions.

Conclusion

KPR Mill has relisted on the National Stock Exchange of India (NSE) since 2007. Showing steady share price growth over the past decade. However, as with any investment, there remain risks and uncertainties that investors should be aware of before making any decisions.